The Elliot Wave Theory is one of the best descriptions of the social and crowd behavior and is defined by easily recognizable repetitive trends and reverses. This theory was developed by American accountant and author Ralph Nelson Elliott. Who extensively studied the stock market and found that the chaotic manner in which the stocks move are actually repetitive cycles. This theory is often used by stock market traders and analysts to spot the upcoming trends in the markets.

According to the principle, investor psychology passes from optimism to pessimism and vice versa, in sequences. These upward and downward ‘mood swings’ can be seen as repetitive price movement patterns that are driven by the collective psychology.

Theory Interpretation

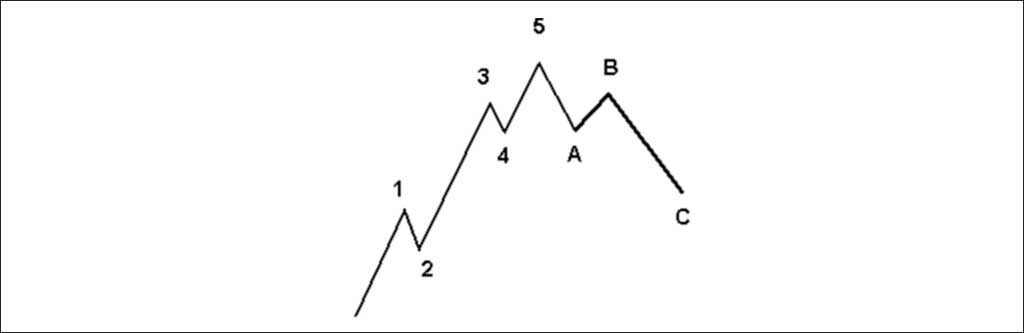

According to this elliot wave theory there are five waves in the dominant trend and this is usually followed by three waves in the corrective trend. In a bullish market the dominant waves go up and then down in the corrective cycle while in a bearish market it is vice versa.

Dominant Trend

As you can clearly see in the graph Wave 1 is impulsive which is followed by is Wave 2 which is corrective in nature. However not corrective enough that it passes the point from where Wave 1 originated. Wave 3 is again an impulsive wave and in most cases it is the biggest of all in the dominant trend. It moves well past where Wave 1 had terminated. Wave 4 is again corrective wave but it is a marginal correction and doesn’t dip below the point where Wave 1 had peaked. Wave 5 is the final part of the dominant trend and the moment it peaks the corrective trend starts.

Corrective Trend

Wave A is the first part in the corrective trend and starts from where Wave 5 peaks. This trend goes in the opposite direction of the Dominant Wave. This Wave A is in many case at par with Wave 4 in the dominant cycle. Wave B is the last impulsive wave and is often referred to as the correction of correction and is actually a temporary reversal. Wave C is the final wave in the cycle and is the final correction of the overall trend. It is on most occasions bigger than Wave A.

The corrective trend is usually followed by a small spells of dominant trend depending on the market environment. However this trend is for mere demonstration and their movements may vary based on the ground realities of the market and the individual stocks.

Observation in Wave Theory:

There are certain rules to be kept in mind while analysing the Wave theory to validate the model authenticity.

-

- Wave 2 never retraces more than 100% of wave 1 i.e. it cannot go below zero level where Wave 1 starts.

The image above shows a break below the start point of the wave sequence, thus negating the notion that it is wave 1. - Wave 3 cannot be the shortest of the three waves.

- Wave 2 never retraces more than 100% of wave 1 i.e. it cannot go below zero level where Wave 1 starts.

The image above highlights the instance when we see a third wave that is too short, thus negating the rule. Thus, the subsequent waves will remain part of the 3 wave rather than forming Wave 4 and 5.

-

-

- Wave 4 cannot enter the area of wave 1.

- Wave 4 cannot enter the area of wave 1.

-

The above Image shows Wave 4 is trading in the area of wave 1point instead remaining within wave 3. Thus, violating the Trend Cycle.

-

-

- Wave 5 will be the Steepest of among all Impulsive waves and also be the final Impulsive wave after which corrective waves will start to work.

-

Theory Classification

The classification of these waves can vary on any particular degree and duration. A number of factors can have a bearing on the occurrence of these cycles. For better understanding of the cycles, trade analysts and economists agree to the following durations –

-

- Grand Supercycle – A grand super cycle theoritically occurs once in few centuries

- Supercycle – This is a multi-decadal phenomenon unusually 40 to 70 years

- Cycle – It is usually one year to several or even decades in certain conditions

- Primary –This can happen in a few months to a couple of years

- Intermediate – These occur between few weeks to months

- Minor – These waves occur in a few weeks

- Minute – These waves take place in a few days

- Minuette – Cycle of waves happening in a few hours

- Subminuette – These are the lowest duration of waves and happen every few minutes

The Relationship of Fibonacci within waves

Elliott after years of analysing his waves, concluded that the Fibonacci series was the basis of the Wave principle. Fibonacci numbers appear again and again in Elliott wave structures – from motive waves (1, 3, 5) to the far more complex patterns. Elliott didn’t specifically utilise Fibonacci levels, yet traders have applied them as a way to add greater complexity to the traditional theory.